【新闻趣读】

"人走茶不凉"的另类诠释:真主党前老板纳斯鲁拉虽已遭以色列空袭"下线",却在巴格达街头开启"刷脸"模式。这位伊朗"天团"成员的巨幅海报,与伊拉克、伊朗、黎巴嫩什叶派民兵领袖们组成"德黑兰男团"——虽然C位已逝,但伊朗"金主爸爸"的应援力度丝毫未减!

---

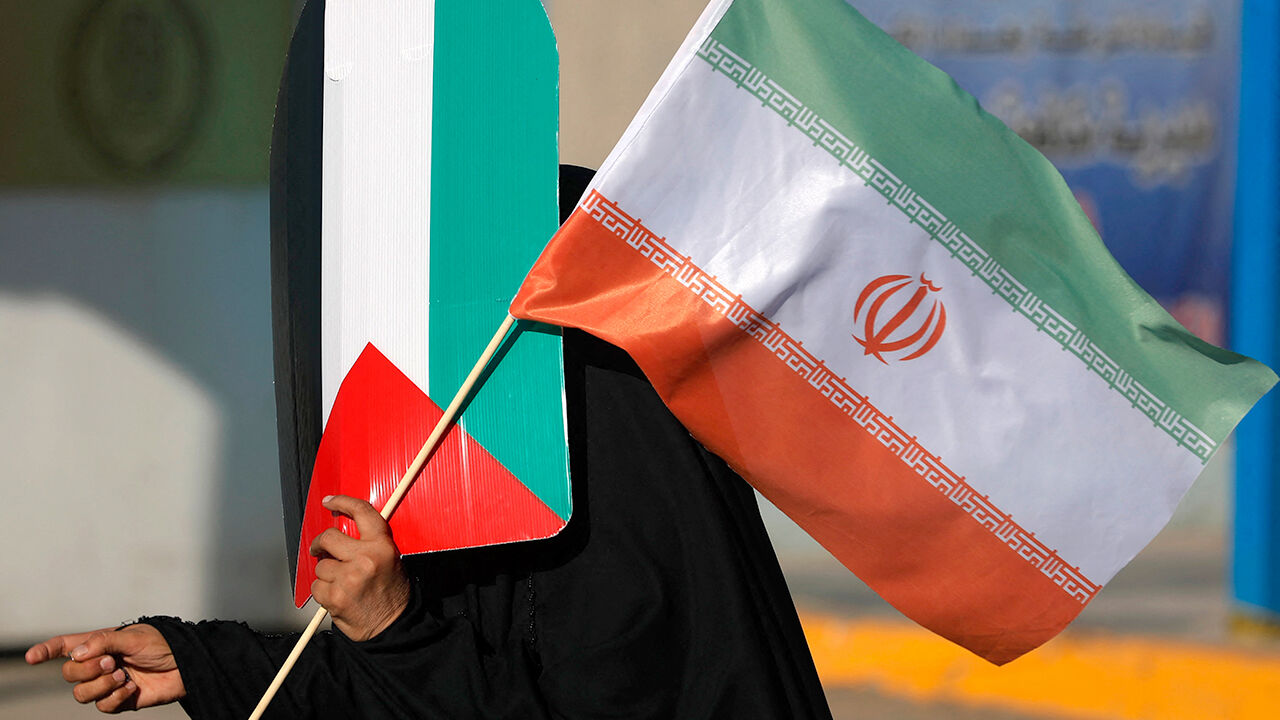

**HE WAS KILLED by an Israeli air strike in Lebanon last year.**

他去年在黎巴嫩遭以色列空袭身亡。

**Yet the face of Hassan Nasrallah, formerly the boss of Hizbullah, is still plastered on posters all over Baghdad, Iraq’s capital.**

但真主党前领导人哈桑·纳斯鲁拉的面孔仍遍布伊拉克首都巴格达的海报。

**Alongside them are images of other Shia militia leaders from Iraq, Iran and Lebanon.**

与之并列的是来自伊拉克、伊朗和黎巴嫩的其他什叶派民兵领袖画像。

**They have one thing in common: their outfits are backed by Iran.**

他们有一个共同点:这些组织都受到伊朗支持。

(注:1."plastered"译为"遍布"准确传达海报数量之多;2."outfits"译为"组织"避免与服装混淆;3.保持"backed by Iran"译为"受到伊朗支持"的客观表述)